COVID-19 Ex-Gratia Faq's

COVID-19 Ex-Gratia to Borrowers for Difference in Interest

FREQUENTLY ASKED QUESTIONS (FAQs)

The bank/ lending institution will provide ex gratia payment to the borrower account of the difference between compound interest and simple interest on loan accounts with sanctioned limits and outstanding upto Rs. 2 crores (aggregate of all the borrowings / facilities from all the banks and financial Institutions) for the period from 1st March 2020 to 31st August 2020 (6 months / 184 days).

The main features / highlights of the scheme are as under:

Loan accounts with sanctioned limits and outstanding not exceeding Rs.2 crores (aggregate of all facilities with all the lending institutions) as on 29.02.2020.

Loan accounts should be standard in the books of the lending institutions as on 29.02.2020.

The relief shall cover the following segments – MSME Loans, Education loans, Housing Loans, Consumer Durable Loans, Credit Card Dues, automobile loans, personal loans to professionals and Consumption loans.

The period reckoned for refund shall be from 1st March 2020 to 31st August 2020, i.e. 6 months period / 184 days.

No. The ex gratia relief will be credited to the Loan account of all eligible borrowers without any requirement to apply.

EIPK FINANCIAL will finalise the list of eligible borrower for the relief based on the GoI guidelines.

EIPK FINANCIAL are to assess this on the basis of information available with them as well as information accessible from credit bureaus.

No. Non fund based limits will not be included for arriving at the eligibility.

Yes, the accounts classified as SMA-0, SMA-1 and SMA-2 as on 29th Feb 2020 are eligible for the relief package.

No. The loan should not be a “Non Performing Asset (NPA) as on 29.02.2020.

Yes. The package will be available for eligible borrowers irrespective of whether they have availed or partially availed or not availed the moratorium on repayment announced by RBI vide DOR. No. BP.BC.47/21.04.048/2019-20 dated 27.03.2020 and extended on 23.05.2020.

Yes, provided that the sanctioned and outstanding amounts do not exceed Rs. 2 Cr. The outstanding as on 29.02.2020 shall be the reference amount for calculating the differential interest amount.

Yes. Such borrowers are eligible for refund of differential interest from 1st March 2020 upto the date of closure of account (not later than 31st August 2020).

The differential amount will be credited to the respective loan account(s) of the borrower.

It will be credited to borrower’s savings/ current account. You can submit the request letter to EIPK FINANCIAL providing the details of the Bank account where the amount can be credited /remitted to.

For Education loans, Housing loans, Automobile loans, Personal loans to professionals and Consumption loans, the rate of interest to be applied for calculating the differential interest component shall be the contracted rate as specified in loan agreements/ documentation applicable as on 29th February 2020.

For consumer durable loans, the rate of interest to be applied for calculating the differential interest component shall be the contracted rate as specified in loan agreements/ documentation. In case where no interest is being charged on equated monthly instalments for a specified period, for the purpose of relief, interest may be applied at FRR rate as the case may be.

MSME: In respect of term loans / Demand Loan, the rate of interest for the purpose of calculating the differential will be the contracted rate as specified in the loan agreements/ documentation applicable as on 29th February 2020.

For Credit Line Accounts, the rate of interest for the purpose of calculating the differential shall be the rate of interest prevailing as on 29.02.2020.

The contracted rate / interest rate prevailing as on 29.02.2020 which is considered for calculating the interest differential will exclude any penalties or any penal rate of interest applied in the account.

The outstanding as on 29.02.2020 will be the reference amount for calculating the differential. Any repayment / credits subsequent from 01.03.2020 – 31.08.2020 shall be ignored for the purpose of calculation.

Simple interest for the period will be calculated based on daily outstanding as at end of the day at rate of interest prevailing as on 29.02.2020. Compounding of interest shall be at monthly rests.

The borrowers can register his/her grievance through this link or visit any of our branches and submit your grievance.

Yes. Loans for consumption purposes (e.g., social ceremonies, etc.) are also eligible for coverage under the scheme, besides other specified categories of loans like consumer durables, automobiles, education, credit card dues, housing and personal loans to professionals. However, loans given for investment in financial assets (shares, debentures etc.) are not eligible for coverage under the scheme.

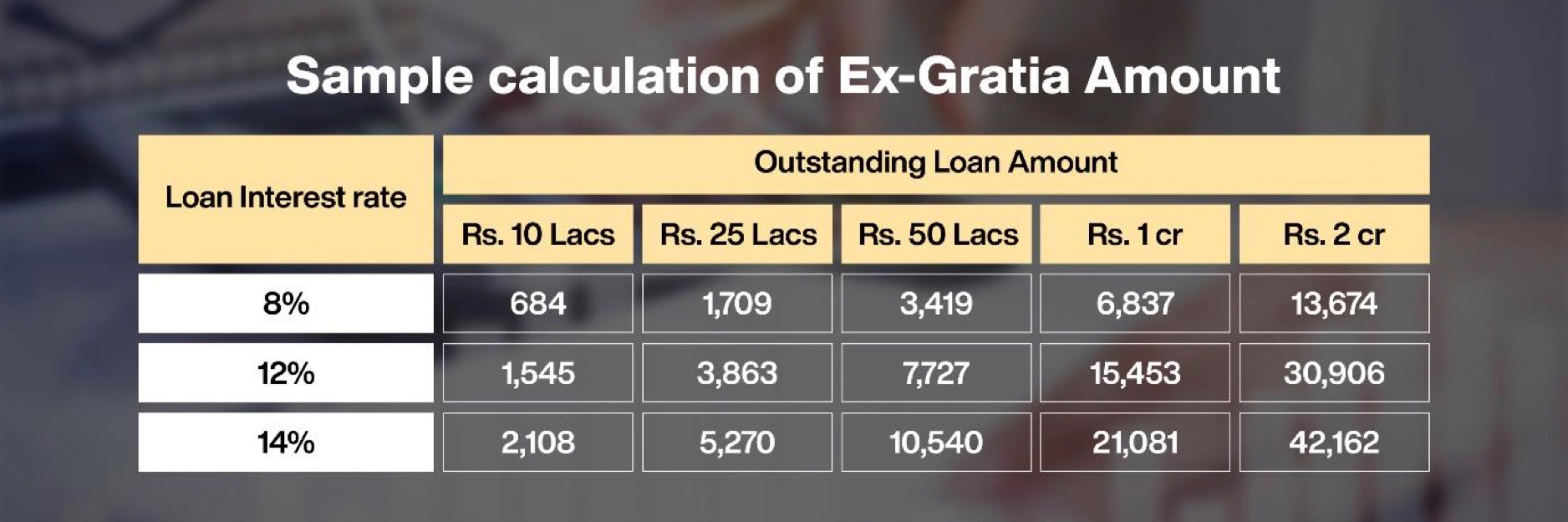

Sample calculation of ex-gratia amount

Note: These are estimated calculations, actual amount may vary.